Venture capitalists only began paying attention to the real estate technology space about a decade ago and, today, solutions aimed at addressing challenges for office space and multifamily have received the most funding and investment. But that’s far from the only sector within real estate in need of technology solutions. There’s much more opportunity.

All told, real estate is a massive, $3.7 trillion market. Delegating software to such a vast piece of the economy is difficult, and just like there is need for vertical SaaS to tackle specifics of each industry, there is need for specialized solutions that address the variances between the many different real estate asset types and their many different stakeholders, such as property managers, tenants, owners and investors. Just like construction depends on the part of the building process you are part of, RE tech depends on the type of assets you are working with.

More specialized sectors of real estate haven’t gotten as much attention, likely because they are thought of as small. And while it’s true that office and multifamily real estate dwarfs each of these specialized sectors, they are still sizable. Another objection some investors may raise is that some of these specialized markets are highly fragmented. Again, that’s accurate, but a strong technology whose implementation costs are small would likely do well — these markets have been grossly underserved when it comes to software solutions that address their challenges.

In this article, we’ll address five sectors of interest: Self-storage, senior housing, student housing, affordable housing and data center facilities. Let’s begin by looking at the size of each market.

- Self storage: A $61.2 billion market in 2023, these properties continue to retain their valuation, averaging $165 / square foot in H1 2023, which is 2.5% above the H1 2022 average. Occupancy is about 90%, which has been stable since Q4 2022.

- Senior Housing: This is a $92.6 billion market in 2023, and average rent growth has hit a historic high of 5.4% this year, per research from AEW. The sector is positioned for growth, with average home sales paying for seven years of average rent in senior housing in 2023 vs four years in 2011. Additionally, demand growth is about 5% while new construction is less than 2% of inventory — the value of existing properties is set to rise.

- Student Housing: There are 15 million off-campus beds in the U.S. across over 2,198 properties, and student housing set an all-time high in transaction volume for 2022 with an annualized total of $18.9 billion, significantly surpassing the previous year-end high of $11.5 billion in 2021 (an estimated 5% of total real estate value transacts per year). Preleasing at schools exceeded 90% in summer 2023, and rents reached a new record high for mid-summer at $849 per bedroom.

- Affordable housing: The global affordable housing market was worth $52.2 billion in 2021. Plus, in the United States, the Inflation Reduction Act of 2022 provided $4 billion in additional funding for the Housing Choice Voucher (HCV) program. The latest available research shows that the shortage of affordable housing grew by half a million units from 2019 to 2021. So, demand is high, but costs are also high – HUD LIHTC mortgages fell 16.2% in 2022 over 2021.

- Data center: The sector was worth $215.7 billion in 2022, and vacancy for primary markets at a record low at 3.3%. Pre-leasing is also strong, with 73.1% of 2.287 MW data centers under construction already pre-leased.

In many of these sectors, companies are managing their business using Excel or, in some cases, without any technology assistance at all, in part because real estate management systems largely don’t account for these specialized asset unique needs.

What’s more, useful data is not available to make good decisions about many of these markets, often because the industries are so fragmented. Self-storage, for example, is very much a mom and pop industry. These small companies typically don’t have robust technology systems or data.

Challenges and opportunities

Each sub-sector has specific, unique challenges and opportunities, which are covered in greater detail below. But, overall, there’s a big opportunity to automate management tasks that are, today, largely manual. Additionally, predictive analytics and AI could enable property managers in these sectors to mitigate risk and assist with marketing and leasing. These solutions, however, must be tailored to meet the very specific needs and challenges of the sector they address.

Self–storage – $61.2 billion market

In self-storage, leases are typically month-to-month with payments via credit card. Pricing can be very fluid, sometimes changing daily. Many operations are owned by smaller local landlords who would greatly benefit from property management technology, were it easy to deploy and priced appropriately. Digital infrastructure could significantly increase efficiency, enable faster and more accurate decision making and increase customer satisfaction.

Specifically, self-storage businesses need property and business management systems that can:

- Handle and even predict fluid pricing

- Predict future leasing trends and vacancy rates

- Manage leasing and marketing

- Accept credit card payments

There’s also an opportunity to collect and provide good data on this highly fragmented market, so managers can make informed decisions on important factors like leasing, acquisitions or development opportunities.

Senior housing – $92.6 billion market

This sector has some similarities to multi-family, as much of the business operates on an apartment lease model, so in some cases, traditional property management software could improve efficiencies.

But there are also profound differences, because senior living also provides services similar to those of a hotel — providing room and meal service — and a medical facility with healthcare providers on staff and the associated requirements to comply with regulations such as HIPAA. Mainstream multifamily software solutions don’t address these unique aspects of their business. As a result, they must rely on cobbled together point solutions that integrate poorly or, more commonly, resort to spreadsheets or paper processes. Specialized solutions could increase efficiency and enable more rapid growth.

There are potential applications for technologies that can be derived from hospitality, multifamily and even medical offices to improve the operations and experience for senior housing. Specifically, these property management solutions should assist with:

- Regulatory compliance

- Managing hospitality services such as room service and housekeeping

- Managing medical staff

- Managing relationships with tenants’ children, who may have power of attorney, for example

- Changes in stage of life

- Tenants who need to downsize

- Specialty care

All in all, white senior housing may resemble multi-family, there are enough nuances and expectations of this asset class to warrant solutions specifically dedicated to this market.

Student housing – Annualized transaction volume of $18.9 billion in 2022

Student housing may look like multifamily on the surface as well, but scratch that surface, and you’ll find a completely different animal. For starters, leases are almost entirely 12-month contracts with very high turnover all within the same, short time frame. What’s more, these leases can include parents or guardians as co-signers, along with multiple students who share the property.

With so many students living on their own for the first time, the number of work orders can be crushing, because so many are for simple things that residents in an ordinary multifamily situation would take care of themselves — such as a clogged toilet or a flipped breaker. Finally, student housing also often requires managing a relationship with the local institution of higher learning.

Similar to self-storage, a lot of these properties are owned by local landlords who could benefit from property management software capabilities, so long as they are tailored to their specific needs. Automation would significantly reduce the crushing load of lease turnovers that occur during a very short period of time and also streamline management of the excessive number of work orders. Increased efficiency and automation could enable small organizations to expand and scale much faster.

Specifically, they need solutions that can manage and automate:

- A highly concentrated period of high turnover and leasing

- A massive amount of relatively trivial work orders

- Leases that almost always have co-signers

- Ability to charge individuals within a property separately or all of the lessors jointly depending on the circumstance

Affordable housing – $52.2 billion market

This is another sector that’s similar to multifamily, but it includes specialized tax and government subsidy consideration. Tax credits can be used for the development of affordable housing properties, while renters may apply for and receive government assistance with rent, which requires oversight. Finally, there’s a requirement for affordable housing companies to follow federal regulations that govern affordable housing.

The affordable housing sector needs software that enables property management similar to multifamily, but includes capabilities to manage the areas where it differs. Increased efficiency and automation would enable affordable housing companies to expand in a market that is severely underserved. Specifically, the sector needs solutions that address:

- Tax credit analysis and transfer

- Compliance with government regulations and reporting

- Applying and tracking vouchers for leases

The affordable housing asset class is distinct in its resiliency even during downturns. It is also poised to grow as the pressure to solve the US housing crisis mounts, and expand to include workforce and attainable housing. As such, specialized management solutions will emerge to help owners and property managers deal with the nuances of these assets.

Data center – $215.7 billion market

The data center space is essentially industrial real estate, but with unique features that make it significantly different from the rest of that space, such as highly specialized electrical, physical security and cooling requirements. These facilities are so dependent on electricity that their capacity is not measured in square footage but in KW or MW of power. Proptech solutions need to address:

- Energy management and usage

- HVAC management

- Physical security

These assets have specialized building, management, and security implications, which combined with global growth in this asset class, should see an uptick in interest.

The opportunity for technology investors

For starters, it should be clear that these “niche” sectors are not niche in the sense of being small. To the contrary, these are large multi-billion dollar markets with the potential to provide technology investors with significant returns. What’s more, there has not been much investment activity to develop software solutions for these sectors, which means there’s not much competition.

Of course, there’s a reason there hasn’t been much investment. Most of these sectors are highly fragmented. But to succeed, these solutions must be tailored specifically to the sector’s needs and – this is critical – be easy to implement and maintain. In fact, enabling these spaces with digital infrastructure could make them more accessible to owners and operators who may not have direct institutional knowledge of these segments, enabling them to expand their portfolios without fear of mismanagement.

In the real estate sector, there are tech opportunities outside of traditional office space and multifamily. These sub-sectors are sizable, and, while they have begun to experiment with more purpose-built technology solutions, most are still largely using Excel, which presents an almost greenfield opportunity for entrepreneurs and investors who are willing to learn the spaces and understand their unique challenges. These overlooked sectors deserve attention from technology entrepreneurs.

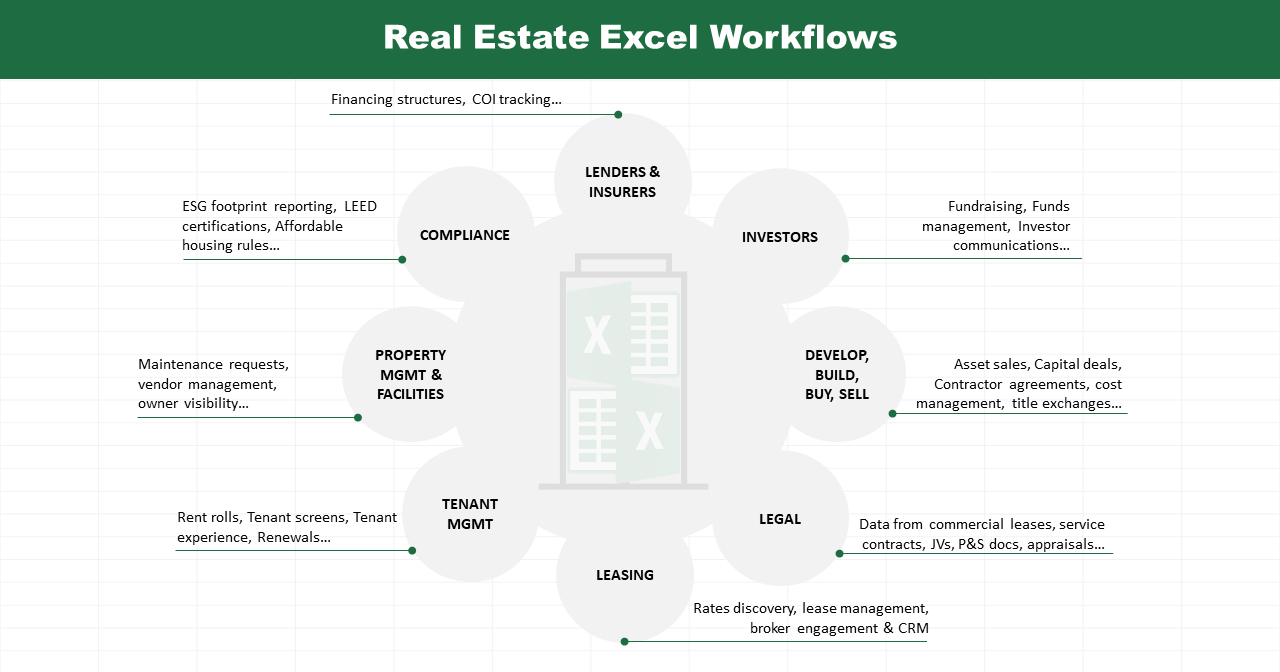

Software may have eaten the world, but in the real estate industry, Excel has eaten all of the workflows. It’s the standard platform that runs the business, from companies small to very large. Of course, a few forward-thinking real estate organizations do use advanced technologies. Blackstone, for example, has been an early adopter of AI and data analytics, building a 50-plus person team of data scientists who have developed a sophisticated AI infrastructure. But the fact is, many billion-dollar real estate companies run their businesses on spreadsheets, analyzing everything from lease payments to maintenance orders in Excel. In fact, many organizations take data from their accounting systems and put it into spreadsheets to analyze it.

To some who don’t work in the industry, this may seem a strange and inefficient choice, but spreadsheets do have significant advantages. Spreadsheets are transparent. Anyone can view the underlying data and the formulas used to calculate results. And the basic calculations that real estate companies must do aren’t particularly complex – many can be jotted out and calculated by hand. Plus, it’s more than three decades old, so it’s a well-understood and trusted technology. In real estate, these two qualities – transparency and trust – carry a lot of weight. In fact, venture capitalists didn’t really start investing in real estate technologies in earnest until about ten years ago.

But there are significant issues with relying so heavily on spreadsheets, as any technologist or tech investor knows. They are not scalable and rapidly become complex, idiosyncratic documents that only a few people within the organization truly understand. Then there’s the issue that spreadsheets are largely manual, with a high potential for human error. And finally there’s the lost opportunity cost of losing intelligence. According to a recent report from McKinsey, generative AI alone could generate as much as $180 billion in additional value for the real estate industry.

The Problem of Data and Documents

Real estate also has a data problem. In the industry, data is typically not well organized, residing in isolated silos throughout the organization, and there’s no standard terminology for classifying information. Different sub-sectors have different names for the same type of data, and while there is an industry effort to standardize data, progress towards large-scale adoption has been slow. These data challenges make it difficult, if not impossible, to gain a holistic view of an organization’s assets or to obtain useful insights using analytics or AI technologies.

As a result, management has to make pivotal decisions — nine-figure asset sales, leasing rates, budgeting, capital deals, financing structures — all using spreadsheets on a property by property basis (spreadsheets which either use manual Excel models using data pulled from a variety of sources including budgeting, accounting and forecasting platforms). Crunching numbers required to make decisions is laborious, and decision-makers are usually working off of imperfect, partial data. Getting the basic information to inform routine, day-to-day decisions is challenging. Doing more creative analysis that could unearth surprising insights that create a competitive advantage is almost impossible.

Real estate also faces a massive challenge managing legal documents. Complex commercial leases, for instance, can run hundreds of pages, and there’s no standard lease in the US for commercial tenants. In many cases they differ from business to business and tenant to tenant, especially when factoring in exhibits and amendments. What’s more, extracting and summarizing the important data is still mostly a manual process that requires a lot of time and money to accomplish and can introduce costly human errors.

But leases are just the tip of the iceberg. There are also service contracts, joint venture documents, loan documents, purchase and sale documents, appraisals and many more. These are all complex documents that contain important data, and it’s extremely difficult to find, retrieve and, ultimately, use it to inform decision-making models.

A Question of Trust

So, it begs the question, why hasn’t real estate adopted purpose-built technologies for data and analytics? As noted above, the primary culprit is a lack of trust. Property tech solutions have failed to deliver the promised results, and real estate companies have been burned many times in the past. In large part, this is because real estate data is extremely challenging to standardize across asset classes, owners, lenders, equity, service providers and owners. What’s more, if real estate professionals can’t see how the numbers are derived, they’re not going to trust the results, and they won’t use the solution.

Excel works, for the most part. People understand it, and, because it’s the standard, they can easily share spreadsheets with their potential partners. They know that they may be missing opportunities because of Excel’s limitations, and, given how manual spreadsheets are, it’s unavoidable that people will make errors with data and formulas.

The larger point, however, is that if there are errors, people from the property company can (theoretically at least) go in and find them. It’s not an opaque algorithm that takes in data on one side and spits out results on the other, with no one having any idea how it got there. There’s no black box of impenetrable and inaccessible software code spitting out numbers. Spreadsheets are completely transparent.

Unfortunately, many real estate practitioners believe valuation is simple, and that there isn’t much value to be gained from data models.To the contrary there are many opportunities to increase efficiency, uncover new opportunities, improve the tenant experience and much more. These missed opportunities are not small. Real estate is falling behind other industries when it comes to understanding and leveraging the vast amount of data it collects. Surely, there is a better way.

Technologies and applications

There are many opportunities for technology solutions within the real estate sector, but before any of these will gain a foothold within the industry, the software must be transparent. Technologists must build trust with real estate industry professionals. End-users will need to be able to verify that the software uses the right numbers and produces correct results.

If that trust can be built, these are the applications that we see as the most promising:

Data standardization: There are data standards that have been proposed for the industry, which would address a lot of the inherent data issues in real estate, but with so many entrenched, bespoke models in use, achieving widespread adherence to an industry standard continues to be an uphill battle.

Real estate needs a transparent solution that standardizes data so it can be consolidated, understood and analyzed. This is an ideal application for AI, but it will need to be carefully trained so that it can recognize and correctly standardize data between different sectors. There are a few firms like Blackrock with the resources to train and develop their own AI technologies, but most will need a solution that’s much more “off the shelf.”

Legaltech: Real estate spends a ton of time and money creating and summarizing lengthy legal documents. A well-trained LLM-based solution could not only automate this process, producing legal documents in minutes that would take weeks or even months to create manually, but it could also extract data from existing documents for further analysis. Additionally, generative AI could rapidly generate reports from lease agreements, such as the median price per square foot of all assets within a certain geographic region or all assets for which the price of maintenance and repair is above a certain percentage of its total income.

Again, however, trust is key. Vendors will need to work closely with customers and ensure that their solutions are transparent, flexible and accurate to gain the industry’s confidence in their solutions’ accuracy.

Spreadsheet replacement

Replacing spreadsheets with solutions that enable real estate organizations to automate data consolidation for more advanced analysis, gives everyone (even those who aren’t spreadsheet gurus) easy access to data and insights and reduces the potential for human error. These solutions can also provide transparency. Dashboarding enables anyone to drill into and interact with the data to unearth insights and also verify and validate the underlying information.

If properly formatted, consolidated, and analyzed, this data could enable predictive maintenance, optimize HVAC to reduce costs and ensure tenant comfort, identify unforeseen operational efficiencies, and streamline reporting to lenders and investors. The right data solutions could enable real estate companies to make better decisions about which geographies, industry sectors and asset classes will be most profitable for investing capital. Real estate technology can provide insight on the advantages and disadvantages of specific leasing components (such as lease concessions vs rent increases vs term) in specific deals.

Advanced data analysis:

There is a great deal of opportunity to derive useful and unexpected insights from real estate. The possibilities are endless, because the data produced by the real estate industry is rich and deep. Landlords have data on tenants and rent payments (all of which can be anonymized); there’s financial data from lenders, accounting and leasing; even the buildings themselves generate gigabytes of information from elevators, turnstiles, HVAC systems, parking …. we could go on. Undoubtedly, there are important patterns and insights hiding in all of that data, just waiting to be uncovered, but it’s mostly going unanalyzed because of the challenges of disparate systems, coding and definitions.

By enabling these use cases, real estate companies will be able to gain the following capabilities:

- Enable more and faster innovation: Data standardization will enable advanced data analysis, whose insights will unearth new opportunities that had previously gone overlooked. These insights aren’t limited to business innovation, however; they can also lead to process and operational innovations.

- Greater efficiency: Replacing spreadsheets with a modern platform will speed up processes and make data more available to those who need it. And leveraging AI to create templates and summaries for legal documents will save days of time.

- Predictions: Freeing data from spreadsheets makes it available to predictive AI, which can make very accurate estimates of future trends for demand, lease pricing, and much more. Real estate companies will be much better positioned to plan for the future and adjust proactively to meet future challenges.

- Use off the shelf models for analysis: Training a large language model (LLM) is expensive and time consuming, requiring a data scientist on staff to oversee the effort. Off-the-shelf models for real estate will greatly shorten the time to value and expense of AI and advanced analytics.

- Reduce error: By automating processes, real estate companies can eliminate the risk of human error which will significantly increase accuracy.

Let’s be frank. In the 2020s, no multi-billion dollar operation should be running its business on a technology that hasn’t changed all that much since the C-suite was in high school. But real estate companies will only move off of Excel if technologists build trust with solutions whose inner workings are transparent and whose benefits are clear. It’s a tall order, but it’s the only way to convince these professionals that there’s a better solution than Excel. They’re leaving billions of dollars on the table that they can’t even see, and only AI and data analytics can show them where to pick it up.