The November 2022 release of ChatGPT sent shockwaves through every industry, including the built environment. Everyone could easily see for themselves just how powerful generative artificial intelligence (AI) had become. And if AI developers’ predictions about scaling laws are correct, AI will become exponentially more capable not in the next decade, but just the next couple of years.

In Architecture, Engineering and Construction (AEC) specifically, AI may catalyze a wave of innovation for an industry whose tools have not changed much over the last decade. CAD, for example, emerged four decades ago. Revit introduced BIM 20 years ago, and while BIM did begin taking advantage of the cloud in the last decade to create Connected BIM, as Nicolas Mangon, VP AEC Strategy at Autodesk, notes, “Nothing much has changed in the last decade.”

Mangon was one of the speakers and panelists at a half-day summit that Suffolk Technologies recently hosted titled: AI + Design in the Built Environment. This event brought together thought leaders from established tech companies and startups working at the edge of AI to have a real discussion alongside industry practitioners, from developers and owners to engineers, architects, and builders about the key challenges of AI adoption for design and construction. The stacked panels discussed the bottlenecks in the status quo, current applications of AI in AEC, and requirements to enable AI.

The problem with the AEC status quo

The increasing cost of design and construction is a huge challenge. For instance, the costs of designing, obtaining permits, and constructing new buildings have grown to the point that it’s becoming more common for projects to cost more than they are worth. These projects are also rife with delay. More than 1 in 5 (22.7%) projects are delivered more than 250 days late, and more than 1 in 8 (13.4%) are delayed by at least a year.

Part of the problem is that much of the design process is manual and repetitive. When designers themselves make mistakes, they’re hard to catch and fix. And when any of the various parties involved in designing a building makes changes to plans, those changes don’t always cascade down to the final plans in the builders’ hands. These changes can in turn cause errors and misunderstandings that require costly, time-consuming rework.

Another issue is the lack of shared information among the many parties that must collaborate to design and build a new building. There is a strong incentive to successfully complete the project, but not to share analytical data on projects over time. People, companies, and teams come together for two to three years and then never work in the same framework again. After all, while collaborators are giving it their all for years to deliver a building, once it’s done, they might be competitors on a future bid. It’s not that these companies don’t want to play nice and share, but the project-based nature of construction disincentivizes data sharing.

Additionally, even when the various parties do want to share data, doing so is very difficult, due to incompatible systems and lack of data standards. The files that need to be shared across parties are also typically very large, further encumbering shareability and collaboration. Dashboards such as Power BI have helped the industry get more transparency, but that’s just the tip of an iceberg and there’s still a long way to go.

Until the data problem is solved, the industry will continue to suffer from lack of transparency between designers, owners, and builders. And, unfortunately, this situation presents significant challenges accumulating exactly the kind of long-term, project-to-project data that advanced technologies such as AI need to uncover insights and make predictions that could reduce costs and accelerate time to delivery.

AI applications in AEC

While there are challenges with applying AI to the AEC industry today, there are many areas where the latest AI tools can have a meaningful impact on the industry.

Intelligent and Automated Design Solutions

We are not yet — and may never be — at a point where AI can properly design a building start to finish. But it has become clear that AI can provide meaningful assistance to designers. For instance, AI could analyze a design and produce a manifest of all the required materials or, even better, suggest design or material changes that could save money without significantly changing the vision for the building. They could also train on prior designs to provide components such as a bathroom or office. Already, solutions exist that will scan the design for code and logic errors, such as walls that don’t align or violate building codes.

“Error detection is a big benefit,” says Jim Dray, principal and CIO at Thornton Tomasetti, an engineering firm that optimizes the design and performance of structures, materials and systems in AEC. ”I’d love to run an expert system on a BIM that says, ‘These 12 things don’t look likely. A human should check it out.’”

Model Sharing

AI can also help reduce the size of models and make it easier to share models and other information across stakeholders, because the problem is not just one of will. It’s also a technology problem, and AI can assist with making sharing much easier.

Gryps, for example, is building an AI-powered platform that finds and makes data easily accessible to AEC stakeholders in a secure manner. And Speckle is building an AI-powered, open-source platform that enables AEC organizations to manage, share and easily access 3D design data in CAD/BIM, parametric design, and even custom tools. Companies can extract and exchange data in real time from AEC apps, curate and share objects instead of giant binary blobs of data and collaborate across teams and disciplines. Thornton Tomasetti is also addressing this challenge with Konstru, a startup that spun out of its internal accelerator, TTWiiN.

Digital Twins

To Mangon at Autodesk, digital twin is one of the more powerful capabilities AI can enable. A digital twin creates a virtual model of the project which can then be used to assess how different events will affect scheduling, manufacturing plans and even the building itself. Changes, such as a delay in the delivery of key materials, can be run through the digital twin to see exactly how they will affect cost and schedule, along with any unexpected impacts on other aspects of the building. In an industry that is perpetually risk averse, enabling consideration of disparate data sources can help assess and manage risk proactively.

“BIM was sold as a holy grail where everything in the field can be done in the office, but getting that model to be accurate is painful, especially for subs,” said Raghu Kutty, CIO at Power Design, a company that provides multi-trade design-build services for electrical, mechanical, plumbing, and systems technologies. “I want construction tech companies to make it possible for changes to flow through to a BIM model with everything updated in real time.” AI can also assist with proliferating those changes across several stakeholders, without the need for duplicative data tracking and input.

Efficient Design

Modular design is slowly creeping in as a model for creating buildings in the industry, with prefabricated components coming to use on projects. Modular design was created in part to address all the complexity and dysfunctionality in design by simplifying the design process and driving standardization. AI could help automate the customized workflows in such a way to allow more customization in design itself, while simultaneously making the process more efficient, which could reduce the need for modular approaches.

For instance, the repetitive components of a design (bathrooms, offices, etc.) can be componentized and slotted in automatically during the design phase, which accelerates the process and saves designers and trades from doing repetitive, boring work. AI can adjust and optimize each component to provide more efficient use of standardized materials and analyze past building designs to optimize new designs. In this way, designers and trades can free up their time to design more unique aspects of buildings, rather than focus on repetitive details.

Environmental Reporting

Environmental reporting is another area in which AI support will likely prove invaluable. Embodied carbon reporting is becoming a standard requirement in many states and cities, but even where local laws don’t apply, owners such as Google and Meta expect it. In fact, pressure to provide environmental data on buildings could very well be the factor that finally persuades the industry to lower its data barriers and become more transparent.

Requirements to enable AI

The promise of AI to increase the efficiency and accuracy of the design process is enormous, but enabling AI requires a lot of data, which is a challenge for an industry where stakeholders have been traditionally very reluctant to share.

”The integrated design process of the last 10 years isn’t working. Getting data on a technical side works, but we’re so siloed and resistance at one level messes up all the others,” said Michael Williams, Managing Partner at Hazelview Investments, an investor, owner and manager of real estate investments.

AEC is an extremely competitive business, and this year’s partner could be next year’s competitor. Understandably, people don’t want to share data that could be used to gain a competitive advantage over them. But there are ways to share data that don’t compromise proprietary information on internal best practices and methodologies.

The usage of synthetic data, for example, is an avenue pursued by multiple technology companies to train machine learning models in circumstances where real data is difficult and/or very expensive to obtain. Synthetic data are artificially created sets of data created by algorithms that contain accurate representations of the salient features and characteristics of real design data. It could provide a partial solution to the data sharing problem. According to Francesco Iorio, CEO of Augmenta, a company that provides automated design solutions for MEP, synthetic data provides value while also ensuring privacy and avoiding compromising proprietary information.

Synthetic data is already in use for training AI in situations where it’s difficult to collect a critical mass of real data. In fact, Gartner predicted in 2023 that by 2024, “60% of data for AI will be synthetic to simulate reality, future scenarios and derisk AI.” For example, Amazon’s Alexa AI system was partially trained on synthetic data for its natural language understanding (NLU) system, and financial giants such as J.P. Morgan have used it to train fraud detection models. Given our industry’s challenges in sharing data, synthetic data could provide a way forward for AI until data sharing becomes easier and more commonplace.

“We can go a long way with synthetic data,” Iorio says. “Project data can be used for other purposes, like unearthing some unwritten rules that pertain to individual firms, and that may remain so. People don’t necessarily have to give up proprietary secrets.”

Even if the industry does begin to share data though, the question is how. The giants of the industry are just now starting to create interoperability standards, which should aid in sharing data sets across different design tools. The lack of a standard has made building data sharing solutions that work with multiple applications and platforms extremely difficult. Companies like Speckle help further address these challenges by creating an open-source environment for model sharing, and creating a community of like-minded individuals that encourage collaboration.

“AI can help companies share only data related to the specific project. Ultimately, though, growing incentives to share will change the industry’s approach,” notes Jim Dray. “Eventually, those firms that share data will gain competitive advantages over those that do not, and, once it becomes apparent that transparency increases profitability, the data floodgates will finally open.”

“This change will happen because people will make more money by pooling data,” Dray added. “Capitalism will be the driver.”

Sustainability is another force pushing the industry to share data. In fact, Anneli Tostar, CEO of Tangible, a company that helps real estate developers and owners manage and reduce emissions from building materials, says that “sustainability is the Trojan Horse for collaboration. This data needs to be legible by multiple stakeholders.” Tostar described how AI can facilitate accurate environmental reporting that shows auditors exactly how figures were determined. As owners and regulators increasingly expect to see environmental impact data in their buildings, project partners will need to share data to comply.

While capitalism and sustainability are two great forces that may start aligning incentives among a fragmented set of stakeholders, ultimately, it may be up to owners to set standards and push for data access and data sharing. As Williams notes, owners are in the right position to ask and receive information from all parties during the building process. But, if owners are to understand what data they already have and what they’re still missing, they’ll need some technological help. As Amir Tashibi, CTO at Gryps, said “Fragmentation is here to stay. Owners have multiple systems, and they’ll stay like that for the most part.” His company provides solutions that enable AEC companies to aggregate and access data from disparate systems so it can be analyzed.

AI has the potential to propel AEC forward toward previously unthinkable gains in efficiency, accuracy and profitability, as the speakers at AI + Design in the Built Environment event demonstrated. But realizing this dream will require the industry to shed its fears of sharing information and embrace new technologies that will facilitate data transparency. Forward thinking firms that begin collaborating and sharing data now, before business and regulatory pressures make it impossible to do business without transparency, will gain significant advantages that will set them apart and ahead of competition.

About Suffolk Technologies + BOOST

Suffolk Technologies is a venture capital platform funding the next generation of companies solving built environment challenges. Affiliated with US-based Suffolk, an ENR Top 25 General Contractor, Suffolk Technologies incubates, accelerates, deploys, and invests in high-impact technologies solving key challenges across the built environment.

BOOST is Suffolk Technologies’ flagship accelerator program designed to ignite growth and equip pioneering built world startups with the right tools to transform the industry. BOOST surrounds founders with design, engineering, infrastructure, and construction experts, successful built world entrepreneurs, venture capitalists, and leading academics. Startups will be launched into the built environment with direct access to jobsites, unparalleled operational knowledge, and an influential network of industry leaders.

Who should apply to BOOST?

Founders who want intentional capital and unparalleled industry expertise to develop transformative built world solutions. BOOST offers team-based structured support and a platform of offerings to help you every step of the way, including 40+ Operating Partners, an active community of 360+ domain specific advisors, successful AECO founders, and an extensive talent network to help you build your team. Startups join BOOST at all different stages – some have a product that is ready to scale on Day 1, while others leverage the program to pressure test prototypes, develop, and launch new products in real time with guidance from those who will influence, use, and champion them in the future.

What happens during the program?

Founders will be completely immersed in the built environment for 8 weeks. While the program officially ends on Demo Day in November, the relationship with Suffolk Technologies, Suffolk and our Operating Partners often continues on for months if not years to come. BOOST isn’t just a program – it’s a community comprised of the best in built world innovation who are all invested in your success and potential to positively impact the industry.

- Pre-Launch Program

The BOOST Pre-Launch Program is a fun, immersive, 1.5 day experience at Suffolk’s national headquarters in Boston. Simply put, the Pre-Launch Program is an opportunity for everyone involved in BOOST to get to know each other before the program officially begins. During this program, founders will have the opportunity to connect with each other, walk an active construction jobsite, spend time with senior leaders at Suffolk and our Operating Partners, meet the BOOST captains, and take part in tailored sessions featuring accomplished founders, go-to-market strategists, and technology leaders in the AECO sector. - Teams

Each startup accepted into the BOOST program will be paired with a dedicated team comprised of Suffolk team members and Operating Partners who are relevant to your company’s core product. Each team will be captained by a Suffolk operational leader, such as a Project Manager, Superintendent, Technology Deployment Expert, Digital Engineer, or Designer. Captains have deep knowledge of the BOOST program and Suffolk’s internal operations, enabling them to help you pilot and gather knowledge from across the organization. The Captain will be responsible for organizing weekly meetings with your larger team, developing a custom roadmap for your BOOST experience, including relevant guests to invite into weekly meetings, and identifying projects that make sense for piloting your technology. - Weekly Programming

BOOST hosts one group programming session every Tuesday (we target late morning EST to accommodate those in different time zones). These programming sessions cover a variety of topics that help you both build your core business (such as perfecting your pitch and preparing to fundraise) and gain deep built world expertise from industry leaders and founders who have successfully scaled and exited startups in this space. - Pilots

The 30 startups that have gone through BOOST have participated in 60+ pilots (and counting) with either Suffolk or one of our Operating Partners. We believe that pressure-testing your technology in the field and gathering honest feedback from end users is the best way to set your product up for success to scale across the industry. Suffolk pilots technologies addressing building design, 3D modeling, preconstruction and construction. If your technology does not fit into Suffolk’s own operations, our network of Operating Partners including materials manufacturers, subcontractors, real estate owners and operators may work with you and test your products with their own internal teams. - Go-to-Market

Each startup will emerge from BOOST with a personalized Go-to-Market plan based on Suffolk Technologies’ proprietary insights from testing and deploying new technology for almost a decade. Throughout the eight weeks of BOOST, your Captain will guide you through a playbook that evaluates your team and technology’s preparedness to sell to your ideal customers. - Demo Day

Demo Day is the pinnacle of the BOOST program when participating founders have the opportunity to pitch their product and accomplishments throughout the program. Demo Day draws a crowd of over 400 industry leaders, investors, academics, and journalists eager to connect with startups that went through the program. Each startup will take the stage to share a five-minute pitch with the audience and then will have the opportunity to network and connect with attendees at our post-Demo Day reception. This year, Built Worlds will host its Venture East conference in Boston the day after Demo Day, providing additional opportunities to pitch and showcase your technology to an audience of innovation leaders and investors.

Does BOOST help with fundraising?

The BOOST program draws attention from both industry-specific and generalist venture capital investors and other financers who both engage in the weekly programming and attend Demo Day. 85% of BOOST alumni successfully fundraised within 18 months of the program ending, and many of them met a future investor at Demo Day. In addition to helping you connect with venture capital firms, BOOST will also make sure that you are well informed on all of your options for financing your company’s growth, including venture debt, project financing, equipment financing, and non-dilutive sources of fundraising such as government grants.

- “The BOOST Deal”

In addition to setting you up for success with your next financing round, Suffolk Technologies will invest $100,000 on a post-money SAFE in exchange for 3% of your company. Most accelerators target startups with 1-2 founders and a pitch deck and will claim 5-10% of your company in exchange for their investment and programming. At BOOST, we do things a bit differently. Because BOOST is designed for startups with at least a working prototype, we recognize that you’ll likely be a bit further along and may have even raised external capital when you join our program. Our goal is to honor the progress and stakeholder interests of your company, while still fostering a partnership aligned for long-term collaboration and success. In addition, Suffolk Technologies often provides follow-on funding to startups that go through the BOOST program. As part of the “BOOST Deal”, Suffolk Technologies is granted the right to invest up to 20% of your next qualified financing round.

Are there any other benefits that I should know about?

Founders who go through the BOOST program gain access to Suffolk Technologies’ entire suite of platform resources. This includes exclusive discounts and offerings from technology partners and service providers, a curated talent network, in-person events throughout the year and, of course, the opportunity to continue working with Suffolk Technologies and our partners after the program ends.

- Partner Offerings

Suffolk Technologies has exclusive offerings from technology and service providers including Agave, Autodesk, AWS, Brex, Brunt Workwear, Carta, Dassault Systems, Drata, Gunderson Dettmer, HubSpot, Insperity, LMRE, Microsoft, Miro, Notion, Nvidia, Rippling, TriNet, Vanta and Zendesk. We also have unique conference engagement opportunities with free or significantly discounted opportunities for our portfolio companies to present at Blueprint, Autodesk University, Procore Groundbreak, and the Built Worlds conferences. - Talent Network

Most startups enter a hyper growth-mode after BOOST and need to fill high-value roles on their teams quickly. Suffolk Technologies can help you fill these positions with our curated talent network. We will refer candidates for any open roles and promote high-priority roles on our public-facing job board and in our newsletter to provide additional visibility. Suffolk Technologies can also help you find advisors, consultants, and contractors as needed. - Beyond BOOST

Once you go through BOOST, you are a part of the Suffolk Technologies portfolio and continue to receive access to the benefits mentioned above, as well as support from our team as you continue to iterate on your technology and connect with potential customers. Our team is never more than a phone call or text message away and we are eager for the opportunity to add value as often as we can.We will also host a virtual BOOST reunion every year, when founders and Operating Partners from every cohort will come together to share their successes, goals, and asks of the community. These reunions often uncover opportunities for collaboration and connections to help you achieve upcoming goals.

Still have questions about BOOST? Email [email protected] or attend one of our upcoming info sessions by clicking here.

Venture capitalists only began paying attention to the real estate technology space about a decade ago and, today, solutions aimed at addressing challenges for office space and multifamily have received the most funding and investment. But that’s far from the only sector within real estate in need of technology solutions. There’s much more opportunity.

All told, real estate is a massive, $3.7 trillion market. Delegating software to such a vast piece of the economy is difficult, and just like there is need for vertical SaaS to tackle specifics of each industry, there is need for specialized solutions that address the variances between the many different real estate asset types and their many different stakeholders, such as property managers, tenants, owners and investors. Just like construction depends on the part of the building process you are part of, RE tech depends on the type of assets you are working with.

More specialized sectors of real estate haven’t gotten as much attention, likely because they are thought of as small. And while it’s true that office and multifamily real estate dwarfs each of these specialized sectors, they are still sizable. Another objection some investors may raise is that some of these specialized markets are highly fragmented. Again, that’s accurate, but a strong technology whose implementation costs are small would likely do well — these markets have been grossly underserved when it comes to software solutions that address their challenges.

In this article, we’ll address five sectors of interest: Self-storage, senior housing, student housing, affordable housing and data center facilities. Let’s begin by looking at the size of each market.

- Self storage: A $61.2 billion market in 2023, these properties continue to retain their valuation, averaging $165 / square foot in H1 2023, which is 2.5% above the H1 2022 average. Occupancy is about 90%, which has been stable since Q4 2022.

- Senior Housing: This is a $92.6 billion market in 2023, and average rent growth has hit a historic high of 5.4% this year, per research from AEW. The sector is positioned for growth, with average home sales paying for seven years of average rent in senior housing in 2023 vs four years in 2011. Additionally, demand growth is about 5% while new construction is less than 2% of inventory — the value of existing properties is set to rise.

- Student Housing: There are 15 million off-campus beds in the U.S. across over 2,198 properties, and student housing set an all-time high in transaction volume for 2022 with an annualized total of $18.9 billion, significantly surpassing the previous year-end high of $11.5 billion in 2021 (an estimated 5% of total real estate value transacts per year). Preleasing at schools exceeded 90% in summer 2023, and rents reached a new record high for mid-summer at $849 per bedroom.

- Affordable housing: The global affordable housing market was worth $52.2 billion in 2021. Plus, in the United States, the Inflation Reduction Act of 2022 provided $4 billion in additional funding for the Housing Choice Voucher (HCV) program. The latest available research shows that the shortage of affordable housing grew by half a million units from 2019 to 2021. So, demand is high, but costs are also high – HUD LIHTC mortgages fell 16.2% in 2022 over 2021.

- Data center: The sector was worth $215.7 billion in 2022, and vacancy for primary markets at a record low at 3.3%. Pre-leasing is also strong, with 73.1% of 2.287 MW data centers under construction already pre-leased.

In many of these sectors, companies are managing their business using Excel or, in some cases, without any technology assistance at all, in part because real estate management systems largely don’t account for these specialized asset unique needs.

What’s more, useful data is not available to make good decisions about many of these markets, often because the industries are so fragmented. Self-storage, for example, is very much a mom and pop industry. These small companies typically don’t have robust technology systems or data.

Challenges and opportunities

Each sub-sector has specific, unique challenges and opportunities, which are covered in greater detail below. But, overall, there’s a big opportunity to automate management tasks that are, today, largely manual. Additionally, predictive analytics and AI could enable property managers in these sectors to mitigate risk and assist with marketing and leasing. These solutions, however, must be tailored to meet the very specific needs and challenges of the sector they address.

Self–storage – $61.2 billion market

In self-storage, leases are typically month-to-month with payments via credit card. Pricing can be very fluid, sometimes changing daily. Many operations are owned by smaller local landlords who would greatly benefit from property management technology, were it easy to deploy and priced appropriately. Digital infrastructure could significantly increase efficiency, enable faster and more accurate decision making and increase customer satisfaction.

Specifically, self-storage businesses need property and business management systems that can:

- Handle and even predict fluid pricing

- Predict future leasing trends and vacancy rates

- Manage leasing and marketing

- Accept credit card payments

There’s also an opportunity to collect and provide good data on this highly fragmented market, so managers can make informed decisions on important factors like leasing, acquisitions or development opportunities.

Senior housing – $92.6 billion market

This sector has some similarities to multi-family, as much of the business operates on an apartment lease model, so in some cases, traditional property management software could improve efficiencies.

But there are also profound differences, because senior living also provides services similar to those of a hotel — providing room and meal service — and a medical facility with healthcare providers on staff and the associated requirements to comply with regulations such as HIPAA. Mainstream multifamily software solutions don’t address these unique aspects of their business. As a result, they must rely on cobbled together point solutions that integrate poorly or, more commonly, resort to spreadsheets or paper processes. Specialized solutions could increase efficiency and enable more rapid growth.

There are potential applications for technologies that can be derived from hospitality, multifamily and even medical offices to improve the operations and experience for senior housing. Specifically, these property management solutions should assist with:

- Regulatory compliance

- Managing hospitality services such as room service and housekeeping

- Managing medical staff

- Managing relationships with tenants’ children, who may have power of attorney, for example

- Changes in stage of life

- Tenants who need to downsize

- Specialty care

All in all, white senior housing may resemble multi-family, there are enough nuances and expectations of this asset class to warrant solutions specifically dedicated to this market.

Student housing – Annualized transaction volume of $18.9 billion in 2022

Student housing may look like multifamily on the surface as well, but scratch that surface, and you’ll find a completely different animal. For starters, leases are almost entirely 12-month contracts with very high turnover all within the same, short time frame. What’s more, these leases can include parents or guardians as co-signers, along with multiple students who share the property.

With so many students living on their own for the first time, the number of work orders can be crushing, because so many are for simple things that residents in an ordinary multifamily situation would take care of themselves — such as a clogged toilet or a flipped breaker. Finally, student housing also often requires managing a relationship with the local institution of higher learning.

Similar to self-storage, a lot of these properties are owned by local landlords who could benefit from property management software capabilities, so long as they are tailored to their specific needs. Automation would significantly reduce the crushing load of lease turnovers that occur during a very short period of time and also streamline management of the excessive number of work orders. Increased efficiency and automation could enable small organizations to expand and scale much faster.

Specifically, they need solutions that can manage and automate:

- A highly concentrated period of high turnover and leasing

- A massive amount of relatively trivial work orders

- Leases that almost always have co-signers

- Ability to charge individuals within a property separately or all of the lessors jointly depending on the circumstance

Affordable housing – $52.2 billion market

This is another sector that’s similar to multifamily, but it includes specialized tax and government subsidy consideration. Tax credits can be used for the development of affordable housing properties, while renters may apply for and receive government assistance with rent, which requires oversight. Finally, there’s a requirement for affordable housing companies to follow federal regulations that govern affordable housing.

The affordable housing sector needs software that enables property management similar to multifamily, but includes capabilities to manage the areas where it differs. Increased efficiency and automation would enable affordable housing companies to expand in a market that is severely underserved. Specifically, the sector needs solutions that address:

- Tax credit analysis and transfer

- Compliance with government regulations and reporting

- Applying and tracking vouchers for leases

The affordable housing asset class is distinct in its resiliency even during downturns. It is also poised to grow as the pressure to solve the US housing crisis mounts, and expand to include workforce and attainable housing. As such, specialized management solutions will emerge to help owners and property managers deal with the nuances of these assets.

Data center – $215.7 billion market

The data center space is essentially industrial real estate, but with unique features that make it significantly different from the rest of that space, such as highly specialized electrical, physical security and cooling requirements. These facilities are so dependent on electricity that their capacity is not measured in square footage but in KW or MW of power. Proptech solutions need to address:

- Energy management and usage

- HVAC management

- Physical security

These assets have specialized building, management, and security implications, which combined with global growth in this asset class, should see an uptick in interest.

The opportunity for technology investors

For starters, it should be clear that these “niche” sectors are not niche in the sense of being small. To the contrary, these are large multi-billion dollar markets with the potential to provide technology investors with significant returns. What’s more, there has not been much investment activity to develop software solutions for these sectors, which means there’s not much competition.

Of course, there’s a reason there hasn’t been much investment. Most of these sectors are highly fragmented. But to succeed, these solutions must be tailored specifically to the sector’s needs and – this is critical – be easy to implement and maintain. In fact, enabling these spaces with digital infrastructure could make them more accessible to owners and operators who may not have direct institutional knowledge of these segments, enabling them to expand their portfolios without fear of mismanagement.

In the real estate sector, there are tech opportunities outside of traditional office space and multifamily. These sub-sectors are sizable, and, while they have begun to experiment with more purpose-built technology solutions, most are still largely using Excel, which presents an almost greenfield opportunity for entrepreneurs and investors who are willing to learn the spaces and understand their unique challenges. These overlooked sectors deserve attention from technology entrepreneurs.

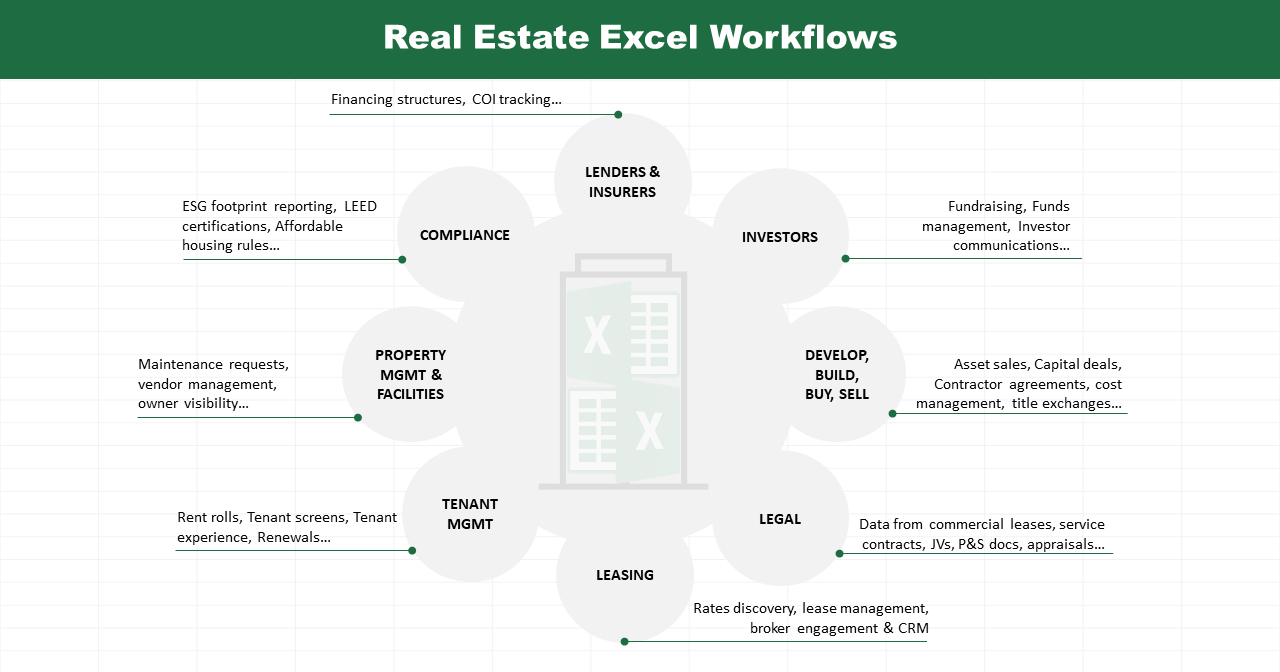

Software may have eaten the world, but in the real estate industry, Excel has eaten all of the workflows. It’s the standard platform that runs the business, from companies small to very large. Of course, a few forward-thinking real estate organizations do use advanced technologies. Blackstone, for example, has been an early adopter of AI and data analytics, building a 50-plus person team of data scientists who have developed a sophisticated AI infrastructure. But the fact is, many billion-dollar real estate companies run their businesses on spreadsheets, analyzing everything from lease payments to maintenance orders in Excel. In fact, many organizations take data from their accounting systems and put it into spreadsheets to analyze it.

To some who don’t work in the industry, this may seem a strange and inefficient choice, but spreadsheets do have significant advantages. Spreadsheets are transparent. Anyone can view the underlying data and the formulas used to calculate results. And the basic calculations that real estate companies must do aren’t particularly complex – many can be jotted out and calculated by hand. Plus, it’s more than three decades old, so it’s a well-understood and trusted technology. In real estate, these two qualities – transparency and trust – carry a lot of weight. In fact, venture capitalists didn’t really start investing in real estate technologies in earnest until about ten years ago.

But there are significant issues with relying so heavily on spreadsheets, as any technologist or tech investor knows. They are not scalable and rapidly become complex, idiosyncratic documents that only a few people within the organization truly understand. Then there’s the issue that spreadsheets are largely manual, with a high potential for human error. And finally there’s the lost opportunity cost of losing intelligence. According to a recent report from McKinsey, generative AI alone could generate as much as $180 billion in additional value for the real estate industry.

The Problem of Data and Documents

Real estate also has a data problem. In the industry, data is typically not well organized, residing in isolated silos throughout the organization, and there’s no standard terminology for classifying information. Different sub-sectors have different names for the same type of data, and while there is an industry effort to standardize data, progress towards large-scale adoption has been slow. These data challenges make it difficult, if not impossible, to gain a holistic view of an organization’s assets or to obtain useful insights using analytics or AI technologies.

As a result, management has to make pivotal decisions — nine-figure asset sales, leasing rates, budgeting, capital deals, financing structures — all using spreadsheets on a property by property basis (spreadsheets which either use manual Excel models using data pulled from a variety of sources including budgeting, accounting and forecasting platforms). Crunching numbers required to make decisions is laborious, and decision-makers are usually working off of imperfect, partial data. Getting the basic information to inform routine, day-to-day decisions is challenging. Doing more creative analysis that could unearth surprising insights that create a competitive advantage is almost impossible.

Real estate also faces a massive challenge managing legal documents. Complex commercial leases, for instance, can run hundreds of pages, and there’s no standard lease in the US for commercial tenants. In many cases they differ from business to business and tenant to tenant, especially when factoring in exhibits and amendments. What’s more, extracting and summarizing the important data is still mostly a manual process that requires a lot of time and money to accomplish and can introduce costly human errors.

But leases are just the tip of the iceberg. There are also service contracts, joint venture documents, loan documents, purchase and sale documents, appraisals and many more. These are all complex documents that contain important data, and it’s extremely difficult to find, retrieve and, ultimately, use it to inform decision-making models.

A Question of Trust

So, it begs the question, why hasn’t real estate adopted purpose-built technologies for data and analytics? As noted above, the primary culprit is a lack of trust. Property tech solutions have failed to deliver the promised results, and real estate companies have been burned many times in the past. In large part, this is because real estate data is extremely challenging to standardize across asset classes, owners, lenders, equity, service providers and owners. What’s more, if real estate professionals can’t see how the numbers are derived, they’re not going to trust the results, and they won’t use the solution.

Excel works, for the most part. People understand it, and, because it’s the standard, they can easily share spreadsheets with their potential partners. They know that they may be missing opportunities because of Excel’s limitations, and, given how manual spreadsheets are, it’s unavoidable that people will make errors with data and formulas.

The larger point, however, is that if there are errors, people from the property company can (theoretically at least) go in and find them. It’s not an opaque algorithm that takes in data on one side and spits out results on the other, with no one having any idea how it got there. There’s no black box of impenetrable and inaccessible software code spitting out numbers. Spreadsheets are completely transparent.

Unfortunately, many real estate practitioners believe valuation is simple, and that there isn’t much value to be gained from data models.To the contrary there are many opportunities to increase efficiency, uncover new opportunities, improve the tenant experience and much more. These missed opportunities are not small. Real estate is falling behind other industries when it comes to understanding and leveraging the vast amount of data it collects. Surely, there is a better way.

Technologies and applications

There are many opportunities for technology solutions within the real estate sector, but before any of these will gain a foothold within the industry, the software must be transparent. Technologists must build trust with real estate industry professionals. End-users will need to be able to verify that the software uses the right numbers and produces correct results.

If that trust can be built, these are the applications that we see as the most promising:

Data standardization: There are data standards that have been proposed for the industry, which would address a lot of the inherent data issues in real estate, but with so many entrenched, bespoke models in use, achieving widespread adherence to an industry standard continues to be an uphill battle.

Real estate needs a transparent solution that standardizes data so it can be consolidated, understood and analyzed. This is an ideal application for AI, but it will need to be carefully trained so that it can recognize and correctly standardize data between different sectors. There are a few firms like Blackrock with the resources to train and develop their own AI technologies, but most will need a solution that’s much more “off the shelf.”

Legaltech: Real estate spends a ton of time and money creating and summarizing lengthy legal documents. A well-trained LLM-based solution could not only automate this process, producing legal documents in minutes that would take weeks or even months to create manually, but it could also extract data from existing documents for further analysis. Additionally, generative AI could rapidly generate reports from lease agreements, such as the median price per square foot of all assets within a certain geographic region or all assets for which the price of maintenance and repair is above a certain percentage of its total income.

Again, however, trust is key. Vendors will need to work closely with customers and ensure that their solutions are transparent, flexible and accurate to gain the industry’s confidence in their solutions’ accuracy.

Spreadsheet replacement

Replacing spreadsheets with solutions that enable real estate organizations to automate data consolidation for more advanced analysis, gives everyone (even those who aren’t spreadsheet gurus) easy access to data and insights and reduces the potential for human error. These solutions can also provide transparency. Dashboarding enables anyone to drill into and interact with the data to unearth insights and also verify and validate the underlying information.

If properly formatted, consolidated, and analyzed, this data could enable predictive maintenance, optimize HVAC to reduce costs and ensure tenant comfort, identify unforeseen operational efficiencies, and streamline reporting to lenders and investors. The right data solutions could enable real estate companies to make better decisions about which geographies, industry sectors and asset classes will be most profitable for investing capital. Real estate technology can provide insight on the advantages and disadvantages of specific leasing components (such as lease concessions vs rent increases vs term) in specific deals.

Advanced data analysis:

There is a great deal of opportunity to derive useful and unexpected insights from real estate. The possibilities are endless, because the data produced by the real estate industry is rich and deep. Landlords have data on tenants and rent payments (all of which can be anonymized); there’s financial data from lenders, accounting and leasing; even the buildings themselves generate gigabytes of information from elevators, turnstiles, HVAC systems, parking …. we could go on. Undoubtedly, there are important patterns and insights hiding in all of that data, just waiting to be uncovered, but it’s mostly going unanalyzed because of the challenges of disparate systems, coding and definitions.

By enabling these use cases, real estate companies will be able to gain the following capabilities:

- Enable more and faster innovation: Data standardization will enable advanced data analysis, whose insights will unearth new opportunities that had previously gone overlooked. These insights aren’t limited to business innovation, however; they can also lead to process and operational innovations.

- Greater efficiency: Replacing spreadsheets with a modern platform will speed up processes and make data more available to those who need it. And leveraging AI to create templates and summaries for legal documents will save days of time.

- Predictions: Freeing data from spreadsheets makes it available to predictive AI, which can make very accurate estimates of future trends for demand, lease pricing, and much more. Real estate companies will be much better positioned to plan for the future and adjust proactively to meet future challenges.

- Use off the shelf models for analysis: Training a large language model (LLM) is expensive and time consuming, requiring a data scientist on staff to oversee the effort. Off-the-shelf models for real estate will greatly shorten the time to value and expense of AI and advanced analytics.

- Reduce error: By automating processes, real estate companies can eliminate the risk of human error which will significantly increase accuracy.

Let’s be frank. In the 2020s, no multi-billion dollar operation should be running its business on a technology that hasn’t changed all that much since the C-suite was in high school. But real estate companies will only move off of Excel if technologists build trust with solutions whose inner workings are transparent and whose benefits are clear. It’s a tall order, but it’s the only way to convince these professionals that there’s a better solution than Excel. They’re leaving billions of dollars on the table that they can’t even see, and only AI and data analytics can show them where to pick it up.

About BOOST:

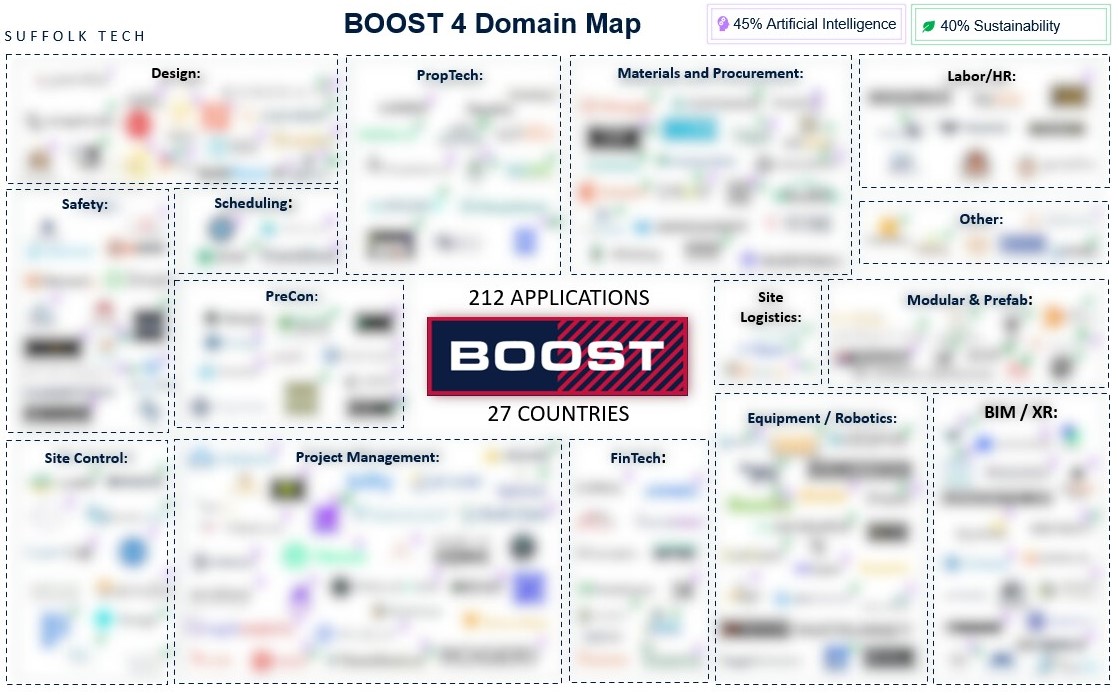

Every year, Suffolk Technologies welcomes the biggest innovators in the Architecture, Engineering, Construction, and Operation (AECO) space for an intense 6-week accelerator program, exposing early-stage entrepreneurs to every facet and detail of the built environment ecosystem. This year, in our fourth edition of the program, we selected seven companies and have been excited to see them progress through challenges they face as founders and technologists in the built world.

BOOST 4 received 200+ applications from 27 countries this year, more than twice the number of applications than when the program started in 2020. The applicants touched on all aspects of the built environment, with a strong showing across six key themes including artificial intelligence, supply chain efficiency, informed sustainability, field-focused digitization, design optimization, and workforce productivity.

The seven companies selected to participant in this year’s cohort, AGORUS, Emidat, Exodigo, Hammr, KayaAI, Sitelink, and Trunk Tools, are building solutions across these six themes and improving their products and go-to-market strategies with the support of Suffolk Technologies and our 22 industry partners.

Talk to me about the themes…

Artificial Intelligence

The question is not if artificial intelligence (AI) can help change the way we build, but rather how it will affect our industry. AI has already begun to transform our industry significantly – new technologies can automate tasks such as checking 2D design documentation for discrepancies, ensuring code compliance, and identifying coordination clashes. Several emerging technologies are using image recognition to automate laborious tasks such as facade inspections, progress tracking, and surveying. In fact, 45% of BOOST 4 applicants, and almost all chosen participants, note AI as a core feature of their products.

Having said that, AI is unlikely to replace construction professionals anytime soon. Many industry reports rank construction at the bottom of the pack when it comes to AI impact1 and, while we believe this impact will be large, we foresee AI working alongside construction professionals to reduce drudgery and drive productivity instead of displacing workers. AI will serve as a co-pilot to automate back-office tasks, prompt contractually driven actions during a project, and easily serve up information when and where it is needed. The differentiation for AI-enabled applications will be centered around the details and timing of inputs and outputs – AI layers that easily integrate into existing systems and processes will be the quickest and easiest for the industry to adopt.

Supply Chain Efficiency

Construction input costs have increased by an average of 26% in 2021 and 2022 due to factors that include lack of transparency throughout the supply chain and delays caused by macroeconomic disruptions such as COVID-192. With limited options available for reducing the cost of raw materials, construction firms are turning to new technologies to help them track the movement of materials, monitor inventory levels, optimize procurement processes, and reduce material waste, ultimately leading to smoother operations and cost savings. For example, AGORUS is utilizing AI-enabled software and robotics to precisely cut and assemble customized timber members of buildings to be installed rapidly on the jobsite, ultimately reducing assembly time, and mitigating costly waste.

We believe the lack of visibility throughout the supply chain can be addressed with technological solutions. General contractors and developers can increasingly leverage software solutions to capitalize on once hard-to-find purchasing power and begin purchasing larger ticket items, such as electrical and mechanical equipment. Other solutions are empowering the offsite tracking and management of materials. For instance, KayaAI has been building tools to integrate AI-driven visibility into our ecosystems’ pre-existing processes and increase lead time visibility on construction projects.

Informed Sustainability

In an era when sustainable business practices are increasingly becoming a competitive advantage, construction firms are exploring how they can address sustainability challenges and transparently communicate their impact. No matter what path firms choose, the first step will be measuring and reporting on various sustainability metrics to demonstrate commitment to sustainable development and meet the demands of stakeholders, regulators, and the broader community. Helping companies navigate the first step are companies such as Emidat. Emidat helps building material manufacturers easily create and distribute environmental product declarations (EPDs), the foundational impact data for embodied carbon stakeholders can leverage to make informed decisions.

The ability to establish industry-wide sustainability baselines will drive the implementation of new processes and methodologies that can power continuous improvements that reduce the built world’s environmental footprint. Metadata collection and aggregation are critical in the coming years as the U.S. slowly, but surely, adopts and pushes for increased reporting and visibility into the materials and processes used to build. There are two key challenges that this new wave of regulations will present for commercial real estate owners: 1) Getting access to reliable and trusted data, which is most often found at the source (such as manufacturers and producers), but also the most difficult to access, and 2) Helping decision-makers across the value chain prioritize the best ROI solutions when it comes to reducing their impact.

Field-focused Digitization

We are excited to increasingly observe technology tools catching hold with a ‘bottom up’ approach, where adoption starts with superintendents and project managers, rather than a centralized innovation team. The ‘top down’ approach to design, project management, building information model (BIM) creation, and reporting has enabled the industry to set standards, adopt new technologies, enforce consistency, ensure back-office efficiency, and drive continuous improvement in enterprise-wide programs and standard operating procedures. In contrast, the ‘bottom up’ adoption promises to streamline workflows and increase productivity in the field, empower frontline professionals to address challenges with data at their fingertips, and address root causes of project delays and cost overruns.

To reap the full benefits of a streamlined, real-time workflow, the perpetual dissonance between BIM and field updates needs to be solved – a gap Sitelink is trying to address with their AR-powered field app. Their solution was built to enhance collaboration for construction teams by bringing BIM to the jobsite. This explosion of field technology coincides with demographic trends we expect to gain momentum in the coming decade. As more than half of the current labor force phases out of the skilled trades, we expect tech-enabled efficiency gains to become more critical and demanded by the workforce, incentivizing network effects rather than forcing outdated tools on individuals in the field.

Design Optimization

As building designs and code complexity increase, optimizing the time that it takes to create design and construction documents in 2D, and 3D has become a focus for design and construction professionals – and a great seeding ground of many tech companies. With added complexity, the time and effort required from professionals to generate a valid, code-compliant set of drawings has increased tremendously. One way to accelerate the production of these documents is assisting with reality capture of existing site conditions, which helps to not only speed up the design process, but also avoids unexpected problems in the future. This has become especially relevant for project starts. Having accurate information from the outset reduces requests for information in-field, minimizes rework, and streamlines the schedule. Sub-surface mapping solutions, such as the one being developed by Exodigo, can provide a clear picture of the underground, informing partners where to design and build safely with a high level of predictability, and doing so faster and more efficiently than existing intrusive methods.

There are rich opportunities for optimizing design beyond project starts as well. Other solutions focus on AI and automation of certain repetitive design tasks. Today, designs are often created from scratch, rather than leveraging institutional knowledge accumulated through previous projects. Thankfully, pulling in previous details and specs from similar projects from the past is becoming easier with today’s tools, helping architects be more productive with their time. Furthermore, the ability for multiple architects to simultaneously collaborate on a drawing set has circumvented the need for downloading or sharing large file formats, avoiding previously disjointed workflows. With so many components to design, such as balancing aesthetic considerations with functionality, sustainability, and cost-efficiency, technologies that enable a more informed, collaborative design process can meaningfully affect change in the industry.

Workforce Productivity

Workforce productivity stands at the core of the AECO industry’s success and profitability. In an environment where the cost of materials and labor are increasing, optimizing the performance of the construction workforce is critical. From skilled laborers to engineers to project managers to back-office functional roles, harnessing the full potential of human resources is not only essential for meeting deadlines and staying within budget, but also for ensuring the safety and quality of construction projects.

Many startups are addressing issues of productivity in the AECO space. For example, Hammr identified an urgent need among SMB contractors through their social media community (the “Bred to Build” podcast) and addressed those needs by building a tool for automating back-office processes. Other early-stage startups are looking at ways to improve workforce productivity by focusing on the field, solving challenges related to training and upskilling the workforce or aligning pay incentives on the jobsite. Trunk Tools addresses the skilled labor shortage in construction by creating easy to use tools for the deskless workforce, including AI-driven superintendent bots that help answer on-site questions and task-based incentives to drive productivity. With better tools in the field and in the back-office, productivity of the jobsite will increase over time.

What Comes Next

The seven startups selected to participate in the BOOST 4 program spent six weeks working with Suffolk Technologies throughout October and November. The BOOST program allowed them to explore and define new use cases within AECO and refine their products and go-to-market strategies. More than half of all BOOST participants have piloted their technology on Suffolk jobsites and many are also exploring pilots with our Operating Partners including Axiom Builders, Holcim, Sellen Construction, and Century Drywall.

If you are interested in learning more about the BOOST program or becoming involved in the future, please reach out to [email protected] and a member of our team will be in touch.

This year, BOOST is presented in partnership with 22 industry partners including Group Amana, Autodesk, ARCO Murray, Axiom Builders, Century Drywall, Feldman Geospatial, Gunderson Dettmer, Holcim, JLL Spark, Liberty, Liberty Mutual, LMRE, McCusker-Gill, The Martin Trust Center for MIT Entrepreneurship, Moog Construction, Procore, Sellen Construction, Suffolk, Suffolk Design, Swire Properties, Thornton Tomasetti, and Zwick Construction.

Construction has traditionally been viewed through the lens of cost and schedule. Increasingly, it is becoming apparent that a third dimension is coming: carbon.

You don’t have to take our word for it, look at how legislation is moving. New York City’s Local Law 97 requires most buildings over 25,000 square feet to meet aggressive greenhouse gas and energy efficiency standards by next year. Under Boston’s Article 37, all new projects must meet certain performance levels and the city is also currently implementing BERDO which sets emissions standards for large existing buildings. California got into the act last year with the California Green Building Standards Code, and the EU is rapidly implementing legislation that will have impacts for US companies with a footprint in Europe.

But legislation is almost a lagging indicator, as the rest of the market is charging ahead. Investors believe that sustainability is the future. One of the world’s largest investors, BlackRock’s Larry Fink, wrote in his 2022 Annual Letter that the next 1,000 startups worth $1 billion will be those that “help the world decarbonize and make the energy transition affordable for all consumers.” And investors are putting their money where their mouth is; Morgan Stanley estimates that sustainable investment funds had $2.8 trillion under management in 2022 alone, almost doubling from 2018.

Real estate lenders are also increasingly giving loans tied to sustainability performance. With these, borrowers can increase their access to capital, often at more favorable terms, while lenders can better manage climate risk and meet their sustainability commitments to regulators and investors.

Consumers, too, are driving the trend towards sustainability. 70% of new home buyers say green features are desirable or a “must-have”, according to a 2021 survey from the National Association of Home Builders. Almost 1 in 6 are willing to pay more for an “environmentally-friendly” home, and well over half (57%) say they are willing to pay an additional $5,000 for a home if efficiency features will enable them to save at least $1,000 a year in utilities. The willingness to pay also extends to commercial real estate consumers, e.g. tenants. A CBRE analysis of 20,000 US office buildings found that rent was 31% higher for LEED certified buildings; a premium that still held (at 4%) when holding other factors constant.

Given all of these factors, it should come as no surprise that 80% of construction leaders believe sustainability will be a major, near-term driver transforming the industry.

Governments, investors, and consumers are all pushing sustainability because the built world is the largest single contributor to climate change. The built world is responsible for 40% of global C02 emissions, with concrete, alone, accounting for as much as 8%. In London, construction creates 14.5% of particulate matter in the air, a figure that is likely similar for other large cities. And in the United States, construction produces 600 million tons of waste annually.

Requirements for a Successful Sustainable Contech Solution

Emissions in the built world can be categorized into two sources: The emissions associated with raw material processing and construction, i.e. embodied carbon (accounting for ~30%), and the emissions associated with running and occupying the building, i.e. operational carbon (accounting for the remaining ~70%). So technology solutions aimed at enabling the built world to meet these emerging demands for sustainability will fall into one of these two categories.

But it’s not enough for a sustainability solution to reduce GHG emissions or eliminate waste. Successful solutions will combine a strong climate impact with a significant business benefit that hits the bottom line.

Certainly, governments are providing carrots and sticks that will make sustainability more economically viable, and they will play an important role in the journey to green construction and green buildings. But solutions that can rapidly provide both financial ROI and GHG reduction, regardless of aid, will have the greatest likelihood of wide, rapid adoption.

Suffolk Tech’s Sustainability Investments

So, what does all this mean at Suffolk Tech? We invest in solutions to measure, manage, and mitigate the climate impact of the built world, the single largest contributor to GHG emissions. And the solutions we invest in will outcompete incumbents because they are better, faster, and cheaper.

Here are two examples of the kinds of companies we’re backing in this space.

Construction companies currently rely on diesel generators to provide the power they need to build, but there are plenty of issues: it can be hard to hear over the rumble of these giant internal combustion generators, and nearby neighbors certainly don’t like it. Plus they require substantial maintenance, and, if they break down, work comes to a halt. And, of course, burning all that diesel fuel creates tons of GHG emissions.

Moxion Power solves this noisy, dirty problem with a zero emission mobile battery that provides 75kW of power and over 600 kWh of energy. Moxion manufactures their electric generators and also provides temporary-power-as-a-service to customers in the construction, entertainment/events, and electrified transportation industries. Their battery gensets have the same dimensions, run-times, and performance capabilities as traditional diesel generators, with the added benefits of being clean, quiet, and offering superior load flexibility, all while maintaining a lower total cost of ownership (“TCO”).

Because it’s quiet, workers on-site can hear each other more clearly, which improves safety, and work can start earlier in the day because there’s no noise to disturb sleeping neighbors. And it’s extremely reliable, running on software-defined hardware with no moving parts.

Moxion is also a great example of how Suffolk Technologies provides far more than funding to help a company succeed. When the company went through our BOOST Accelerator, we partnered with Suffolk Construction to put Moxion on a jobsite, providing the company, early in its life, with a real-world jobsite where they could exactly determine the requirements their solution would need to meet.

Where Moxion primarily addresses the problem of embodied carbon during construction, WINT provides sustainability and financial benefits during construction and building operations by reducing water waste and preventing water damage.

About a quarter of the water that enters buildings, construction sites, and industrial facilities is wasted through leaks that go undetected. What’s more, water damage accounts for nearly a quarter (24%) of builder’s insurance claims. Water is also a precious resource for people, agriculture, industry and ecosystems, especially in regions such as the American Southwest.

Using market-tested IoT and AI technologies, WINT detects leaks, pinpoints the source and then provides immediate mitigation by shutting off the water to the area that’s leaking, preventing water loss, reducing water bills, and avoiding serious damage. The ROI is so significant, insurance companies are partnering with the startup so that their policyholders will use it.

Again, Suffolk Tech provided more to WINT than cash. We helped the company expand from Israel to the US and gain a strong foothold in the new construction market. We also helped the company understand first-hand how the handoff process works between an owner and a general contractor for insurance and other critical items. Construction companies are often risk-averse, and few are willing to act as a development partner, so getting that kind of experience as you’re honing the solution is critical to market success. Suffolk Tech makes this happen for our portfolio companies.

There’s a massive opportunity to create ROI while enabling sustainable built world solutions. Suffolk Tech is not only investing in these technologies at an early stage, but is connecting startups with our ecosystem to put their products into real-world applications so they can scale to industry-wide adoption.

Carbon is coming. Suffolk Tech is here to support and invest in the companies leading this transformation.

If you’re building a startup that addresses these or other pressing issues in the built environment, please reach out to our team.

We’ll be blunt. Construction has a huge productivity problem. In fact, it’s bigger than you probably imagine, because construction isn’t just failing to keep up with the gains of the overall U.S. labor force, which have averaged about 2.1% annually since 1994. No, construction’s productivity has actually declined from 1970 to 2020 by 40%, according to the National Bureau for Economic Research. And this productivity problem isn’t just an issue for construction — it’s a problem for the entire global economy. Construction directly and indirectly accounts for 13% of the world’s GDP.

Compounding the productivity problem, construction is also suffering from a massive — and likely long-term — labor shortage. To keep up with projected demand, the industry will need to attract an additional 546,000 workers on top of its usual pace of hiring, according to research from the Associated Builders & Contractors. Unfortunately, unless conditions undergo a rapid turnaround, that’s unlikely to happen. Last year, construction averaged 390,000 job openings each month, which is the highest level since stats have been recorded for the industry.

Other industries such as manufacturing have been able to increase productivity, despite sizable challenges of their own. But in construction, we are only in the early stages of what will be a massive transformation.

Suffolk Tech sees AI and automation as the ultimate solution to the industry’s productivity challenges. With our new fund, we invest in solutions and leverage our platform to help rapidly scale the right solutions across the industry. We firmly believe that these technologies can help the industry reverse course to start seeing the kind of productivity growth other industries have experienced.

But, of course, our position begs the question: why is construction still relying on manual processes and technologies that are decades old? Is construction made up of a bunch of technology-hating Luddites?

A Low-Margin, High Risk Industry

The answer to that last question is easy: a strong and emphatic, “No.” Though the explanation why is a bit more complex…

First, it’s important to understand that construction is a high-risk, low-margin business. The typical net profit margin for engineering and construction is less than 3%. That’s comparable to commoditized industries such as grocery stores (2.1%), electronic components (4.1%) and auto parts (2.6%).

As for risk, construction has a ton. In manufacturing, for instance, the environment is largely closed, and conditions inside a facility are controllable. Processes are also highly repeatable, because manufacturers make the same product over and over, gaining efficiency. Construction, on the other hand, is largely outdoors, subject to unpredictable weather and ground conditions. Each building is different, so processes must change from project to project. So, many of the factors that determine the success or failure of a project are completely out of a single company’s control.

Additionally, in construction, time is extremely precious. Late projects incur penalties that can easily wipe away profits, and given how much leverage is involved, owners need to start seeing revenue from their investments as soon as possible. A failed or late project can tie up all the stakeholders in years of costly lawsuits and red ink.

The fact is, in a high-risk environment with low margins and aggressive deadlines, the appetite for changing processes and adopting new technologies historically has been understandably low. Why take a chance on a new technology that could fail and put the entire project at risk? Construction managers see far less risk remaining with the status quo. Nevertheless, the pressures to deliver more buildings, faster, cheaper, and more sustainably are turning many stakeholders towards seeking better technological solutions to previously manual and slow processes.

Near-Term Opportunities for Automation and AI in Construction

To succeed, technology entrepreneurs must first understand the unique challenges of the industry. But that’s just the start. Their solutions must also be:

- Able to deliver rapid ROI: If a construction organization is going to take the risk of incorporating new technology into their workflows, the benefit needs to be significant and immediate.

- Easy to use: In construction, people are extremely busy and working to aggressive schedules. They simply do not have time to learn how to use a complicated UI.

- Mature: While there are construction organizations like Suffolk Construction that are eager to help entrepreneurs develop and improve their solutions, the market at large expects technologies to be ready for prime time.

- Designed with construction’s unique challenges specifically in mind: If horizontally-oriented, general-purpose technology solutions would work for construction, they would have adopted them.

Now that we’ve described the traits a technology solution needs to have for construction, let’s dive a bit deeper into automation and AI, specifically. Generally speaking, there are two spheres where it’s applicable. The first is physical automation, which includes equipment, labor and building management. The other is digital automation for use cases such as data analytics, model-driven design, project management, and others.

There are a multitude of potential use cases under each sphere, but here are a handful of the ones we believe have big near-term potential.

AI-Assisted Design: Currently, the processes for building models, plans, and designs are mostly manual and, probably surprising to many, even paper-based. It’s slow with a high risk of introducing human error. Contractors, for instance, spend weeks creating detailed models prior to build out. It’s a reactive process with very slow iterations, and decisions are often based on gut feelings. A good example of a company that is transforming how trades can leverage design to improve their process is Augmenta.

Augmenta uses AI to create electrical (and eventually mechanical and plumbing) designs within minutes vs months. Their designs are also tied to the bill of materials, which makes estimating fast and accurate. Considering it can take up to two months to create these designs manually with frequent changes required, employing this tool presents a game-changing advantage. Currently, Augmenta can create designs for fully detailed, code compliant, and constructible electrical raceway systems. In the near future, the company will add capabilities for creating plumbing, mechanical, and structural designs.

Data Analytics and RPA (robotic process automation): Capturing and analyzing data about a jobsite is a huge challenge. Manual data entry is, of course, slow and error prone, and manually captured images are often not comprehensive enough and can’t be analyzed at scale by humans. OpenSpace uses machine vision and AI to provide a complete, up-to-date digital view of the jobsite from 360 degree images captured from a camera mounted on a worker’s hard hat or, if available, an autonomous robot.

OpenSpace’s AI goes well beyond creating a digital jobsite view. It can show progress over time, and compare the actual site to a model to identify discrepancies early, when they are less expensive and easier to address. Contractors can also use the solution to simplify communications about scope of work and to document changes.

Robotics: If robots can perform tasks – especially dangerous ones – that are ordinarily completed by humans, they can help alleviate the labor crunch while improving safety, accuracy, and productivity. But the construction environment is super challenging for robots. In manufacturing, robots are ubiquitous, but factory floors are very different from construction jobsites, which are unstructured and always changing. Robots can’t work in isolation; they have to work alongside human workers safely and effectively. They must also be rugged enough to function in bitter cold and scorching heat, braving dust, standing water, uneven floors, and other hazards.

In the last decade, however, robotics has seen tremendous advancements, especially in their ability to move autonomously and collaborate with both humans and other robots. As a result, we’re starting to see young companies roll out robotics solutions designed specifically for construction.

Rugged Robotics, for example, replaces the slow and manual process of field layout with an autonomous robot that marks architectural and engineering (A/E) designs directly onto unfinished floors. It’s faster, more accurate and less expensive than marking floors manually.

Another company, Canvas, makes a worker-controlled robot that uses AI and machine vision to finish drywall 1.5x faster than a completely manual process. Incredibly, nearly every component for the robot is off-the-shelf, including the initial AI and machine vision algorithms, which goes to show just how much robotics and AI have advanced. With Canvas, one worker and a robot can do the work of an entire team faster and more consistently, which is a huge plus for an industry in the midst of a huge labor shortage. Plus, the Canvas robot creates very little dust, creating a healthier work environment with little to no cleanup afterwards.

Construction can see the same kind of productivity gains other industries have experienced through automation and AI, but these technology solutions must specifically address the unique challenges of the construction industry.

There’s still a lot of work to be done, even in getting things like baseline data to enable true AI and automation use cases (which we are also focused on solving with our focus on connected industry). But, one thing is clear, construction needs to change and new AI and automation tools can increase productivity across the industry. The idea of automated construction is not new (as can be seen from Villemard’s depiction of future of building in his 1910 image), but we see great potential on the horizon.

If you’re building a startup that addresses these or other pressing issues in the built environment, please reach out to our team.