Software may have eaten the world, but in the real estate industry, Excel has eaten all of the workflows. It’s the standard platform that runs the business, from companies small to very large. Of course, a few forward-thinking real estate organizations do use advanced technologies. Blackstone, for example, has been an early adopter of AI and data analytics, building a 50-plus person team of data scientists who have developed a sophisticated AI infrastructure. But the fact is, many billion-dollar real estate companies run their businesses on spreadsheets, analyzing everything from lease payments to maintenance orders in Excel. In fact, many organizations take data from their accounting systems and put it into spreadsheets to analyze it.

To some who don’t work in the industry, this may seem a strange and inefficient choice, but spreadsheets do have significant advantages. Spreadsheets are transparent. Anyone can view the underlying data and the formulas used to calculate results. And the basic calculations that real estate companies must do aren’t particularly complex – many can be jotted out and calculated by hand. Plus, it’s more than three decades old, so it’s a well-understood and trusted technology. In real estate, these two qualities – transparency and trust – carry a lot of weight. In fact, venture capitalists didn’t really start investing in real estate technologies in earnest until about ten years ago.

But there are significant issues with relying so heavily on spreadsheets, as any technologist or tech investor knows. They are not scalable and rapidly become complex, idiosyncratic documents that only a few people within the organization truly understand. Then there’s the issue that spreadsheets are largely manual, with a high potential for human error. And finally there’s the lost opportunity cost of losing intelligence. According to a recent report from McKinsey, generative AI alone could generate as much as $180 billion in additional value for the real estate industry.

The Problem of Data and Documents

Real estate also has a data problem. In the industry, data is typically not well organized, residing in isolated silos throughout the organization, and there’s no standard terminology for classifying information. Different sub-sectors have different names for the same type of data, and while there is an industry effort to standardize data, progress towards large-scale adoption has been slow. These data challenges make it difficult, if not impossible, to gain a holistic view of an organization’s assets or to obtain useful insights using analytics or AI technologies.

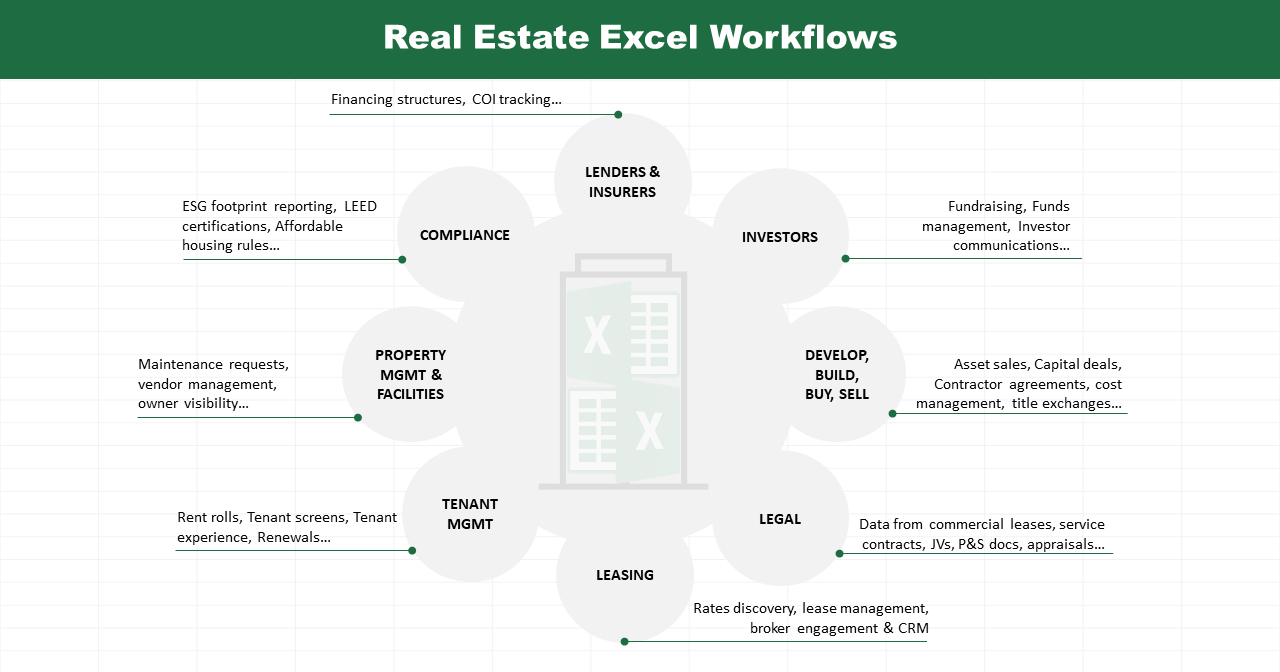

As a result, management has to make pivotal decisions — nine-figure asset sales, leasing rates, budgeting, capital deals, financing structures — all using spreadsheets on a property by property basis (spreadsheets which either use manual Excel models using data pulled from a variety of sources including budgeting, accounting and forecasting platforms). Crunching numbers required to make decisions is laborious, and decision-makers are usually working off of imperfect, partial data. Getting the basic information to inform routine, day-to-day decisions is challenging. Doing more creative analysis that could unearth surprising insights that create a competitive advantage is almost impossible.

Real estate also faces a massive challenge managing legal documents. Complex commercial leases, for instance, can run hundreds of pages, and there’s no standard lease in the US for commercial tenants. In many cases they differ from business to business and tenant to tenant, especially when factoring in exhibits and amendments. What’s more, extracting and summarizing the important data is still mostly a manual process that requires a lot of time and money to accomplish and can introduce costly human errors.

But leases are just the tip of the iceberg. There are also service contracts, joint venture documents, loan documents, purchase and sale documents, appraisals and many more. These are all complex documents that contain important data, and it’s extremely difficult to find, retrieve and, ultimately, use it to inform decision-making models.

A Question of Trust

So, it begs the question, why hasn’t real estate adopted purpose-built technologies for data and analytics? As noted above, the primary culprit is a lack of trust. Property tech solutions have failed to deliver the promised results, and real estate companies have been burned many times in the past. In large part, this is because real estate data is extremely challenging to standardize across asset classes, owners, lenders, equity, service providers and owners. What’s more, if real estate professionals can’t see how the numbers are derived, they’re not going to trust the results, and they won’t use the solution.

Excel works, for the most part. People understand it, and, because it’s the standard, they can easily share spreadsheets with their potential partners. They know that they may be missing opportunities because of Excel’s limitations, and, given how manual spreadsheets are, it’s unavoidable that people will make errors with data and formulas.

The larger point, however, is that if there are errors, people from the property company can (theoretically at least) go in and find them. It’s not an opaque algorithm that takes in data on one side and spits out results on the other, with no one having any idea how it got there. There’s no black box of impenetrable and inaccessible software code spitting out numbers. Spreadsheets are completely transparent.

Unfortunately, many real estate practitioners believe valuation is simple, and that there isn’t much value to be gained from data models.To the contrary there are many opportunities to increase efficiency, uncover new opportunities, improve the tenant experience and much more. These missed opportunities are not small. Real estate is falling behind other industries when it comes to understanding and leveraging the vast amount of data it collects. Surely, there is a better way.

Technologies and applications

There are many opportunities for technology solutions within the real estate sector, but before any of these will gain a foothold within the industry, the software must be transparent. Technologists must build trust with real estate industry professionals. End-users will need to be able to verify that the software uses the right numbers and produces correct results.

If that trust can be built, these are the applications that we see as the most promising:

Data standardization: There are data standards that have been proposed for the industry, which would address a lot of the inherent data issues in real estate, but with so many entrenched, bespoke models in use, achieving widespread adherence to an industry standard continues to be an uphill battle.

Real estate needs a transparent solution that standardizes data so it can be consolidated, understood and analyzed. This is an ideal application for AI, but it will need to be carefully trained so that it can recognize and correctly standardize data between different sectors. There are a few firms like Blackrock with the resources to train and develop their own AI technologies, but most will need a solution that’s much more “off the shelf.”

Legaltech: Real estate spends a ton of time and money creating and summarizing lengthy legal documents. A well-trained LLM-based solution could not only automate this process, producing legal documents in minutes that would take weeks or even months to create manually, but it could also extract data from existing documents for further analysis. Additionally, generative AI could rapidly generate reports from lease agreements, such as the median price per square foot of all assets within a certain geographic region or all assets for which the price of maintenance and repair is above a certain percentage of its total income.

Again, however, trust is key. Vendors will need to work closely with customers and ensure that their solutions are transparent, flexible and accurate to gain the industry’s confidence in their solutions’ accuracy.

Spreadsheet replacement

Replacing spreadsheets with solutions that enable real estate organizations to automate data consolidation for more advanced analysis, gives everyone (even those who aren’t spreadsheet gurus) easy access to data and insights and reduces the potential for human error. These solutions can also provide transparency. Dashboarding enables anyone to drill into and interact with the data to unearth insights and also verify and validate the underlying information.

If properly formatted, consolidated, and analyzed, this data could enable predictive maintenance, optimize HVAC to reduce costs and ensure tenant comfort, identify unforeseen operational efficiencies, and streamline reporting to lenders and investors. The right data solutions could enable real estate companies to make better decisions about which geographies, industry sectors and asset classes will be most profitable for investing capital. Real estate technology can provide insight on the advantages and disadvantages of specific leasing components (such as lease concessions vs rent increases vs term) in specific deals.

Advanced data analysis:

There is a great deal of opportunity to derive useful and unexpected insights from real estate. The possibilities are endless, because the data produced by the real estate industry is rich and deep. Landlords have data on tenants and rent payments (all of which can be anonymized); there’s financial data from lenders, accounting and leasing; even the buildings themselves generate gigabytes of information from elevators, turnstiles, HVAC systems, parking …. we could go on. Undoubtedly, there are important patterns and insights hiding in all of that data, just waiting to be uncovered, but it’s mostly going unanalyzed because of the challenges of disparate systems, coding and definitions.

By enabling these use cases, real estate companies will be able to gain the following capabilities:

- Enable more and faster innovation: Data standardization will enable advanced data analysis, whose insights will unearth new opportunities that had previously gone overlooked. These insights aren’t limited to business innovation, however; they can also lead to process and operational innovations.

- Greater efficiency: Replacing spreadsheets with a modern platform will speed up processes and make data more available to those who need it. And leveraging AI to create templates and summaries for legal documents will save days of time.

- Predictions: Freeing data from spreadsheets makes it available to predictive AI, which can make very accurate estimates of future trends for demand, lease pricing, and much more. Real estate companies will be much better positioned to plan for the future and adjust proactively to meet future challenges.

- Use off the shelf models for analysis: Training a large language model (LLM) is expensive and time consuming, requiring a data scientist on staff to oversee the effort. Off-the-shelf models for real estate will greatly shorten the time to value and expense of AI and advanced analytics.

- Reduce error: By automating processes, real estate companies can eliminate the risk of human error which will significantly increase accuracy.

Let’s be frank. In the 2020s, no multi-billion dollar operation should be running its business on a technology that hasn’t changed all that much since the C-suite was in high school. But real estate companies will only move off of Excel if technologists build trust with solutions whose inner workings are transparent and whose benefits are clear. It’s a tall order, but it’s the only way to convince these professionals that there’s a better solution than Excel. They’re leaving billions of dollars on the table that they can’t even see, and only AI and data analytics can show them where to pick it up.

Connect with Us

Join Ecosystem

Submit a Pitch

Innovation information for your job. Discover cutting-edge construction industry resources, companies, and projects through our monthly email newsletter.